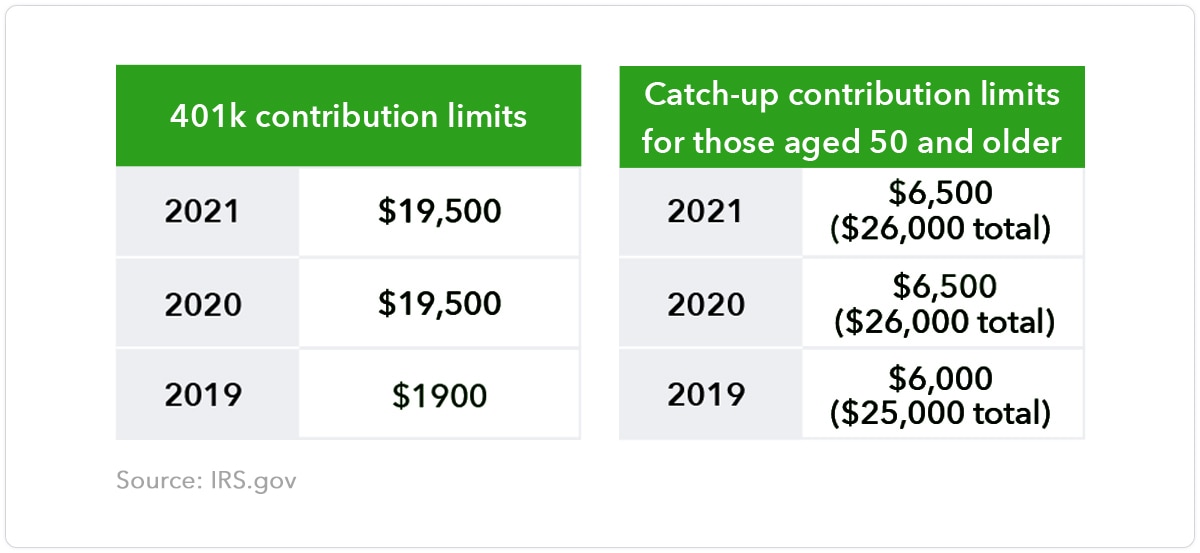

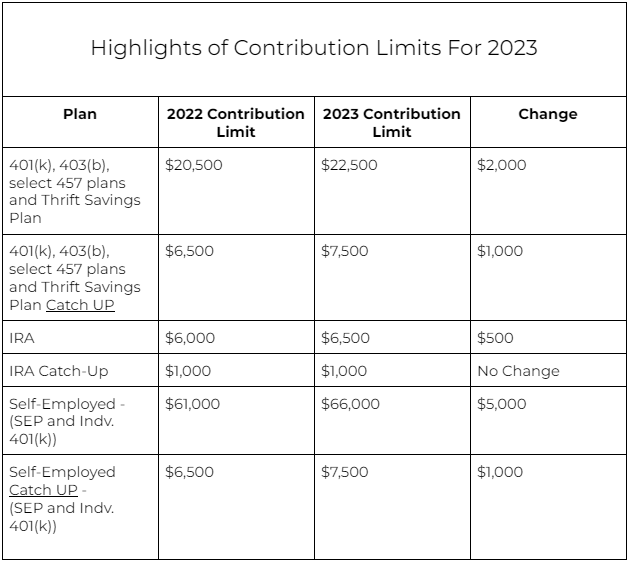

Total 401k Contribution Limit 2025 Catch Up. This ensures that the limits remain meaningful as the cost of living. You can contribute a maximum of $7,000 (up from $6,500 for 2025).

Of note, the 2025 pretax limit that applies to elective deferrals to irc section 401(k), 403(b) and 457(b) plans increased from $22,500 to $23,000. In 2025, the most you can contribute to a roth 401(k) and contribute in pretax contributions to a traditional 401(k) is $20,500.

2025 401k Contribution Limit And Catch Up Dollie Leland, The annual contributions limit for traditional iras and roth iras was $7,000 for 2025, rising from $6,500 for 2025.

Irs 401k Catch Up Contribution Limits 2025 Elisa Germain, In 2025, the most you can contribute to a roth 401(k) and contribute in pretax contributions to a traditional 401(k) is $20,500.

401k Limits 2025 Catch Up Contribution Lexi Shayne, Those 50 and older can contribute an additional $7,500.

401k Contribution Limits 2025 Catch Up Total Robby Christie, The total overall 401(k) contribution limit for 2025, which includes employer matching contributions and nonelective contributions, is $69,000.

Current 401k Contribution Limits 2025 Geneva Charita, The 401 (k) employee contribution limit for 2025 is $23,000.

401k 2025 Contribution Limit Catch Up Rene Kristel, Those 50 and older can contribute an additional.

Catch Up 401k Contribution Limits 2025 Randa Carolyne, For 2025, the maximum you can contribute to a simple 401 (k) is $16,000.

401k Contribution Limits 2025 Catch Up Total Ardeen Amelina, Those 50 and older can contribute an additional.

401k 2025 Contribution Limit Catch Up Casey Kimmie, The roth 401(k) contribution limit for 2025 is $23,000 for employee contributions and $69,000 total for both employee and employer contributions.